Overview

In the month of February we will be sharing a series of educational posts for non-institutional investors. We get a lot of questions about private markets for those newer to the asset class, so the goal is to make it easier to understand and more accessible to the average person.

This week’s post is “What is Portfolio Construction and Why Does it Matter to Venture Capitalists?”

Portfolio Construction

Portfolio construction for venture capital fund managers is a fundamental and necessary activity that is critical to a firm’s long-term success. Each fund manager has a slightly different approach for how they construct portfolios. Regardless of the approach, all are seeking to invest in “enough” companies to increase the probability that a handful of those companies will significantly outperform and make up for the companies that underperform. You may be asking yourself, how much is “enough” and what does it mean to outperform or underperforms. Let’s address the” enough” question first.

There is a law used in statistics called the Power Law. Basically, what it describes is the relationship between two (or more) variables that when working together, produce some defined output. There are different types of power laws, but the one that applies most to Venture is the Pareto Law, often called the Pareto Principle, or more colloquially known as the 80/20 Rule. The 80/20 Rule states that 80% of output is based on 20% of the input. As applied to VC, 80% of returns/profits are driven by 20% of the portfolio. As such, would it make sense for a VC fund manager to invest in 5 companies? 10 companies? 20 companies? 30 companies? or more?

Industry Data

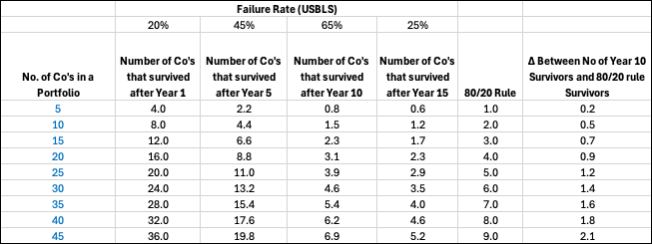

According to the US Bureau of Labor Statistics, 10% of all businesses fail in one year, 45% fail in 5 years, and 65% fail in 10 years. Armed with this data, it’s easy to calculate the estimated number of companies remaining in a portfolio after a set period. For the sake of this exercise, let’s use the 10-year time frame, which is also the same time frame as most venture capital funds (assuming the fund is not extended and is terminated at the end of the 10ᵗʰ year).

Let’s compare a portfolio of five companies to a portfolio of 25 companies (see table below). After 10 years, a portfolio of five companies has less than one surviving company, and a portfolio of 25 companies has just under four surviving companies. Rounding up to whole numbers, a portfolio of 25 companies has 400% more companies that survive than a portfolio of five companies. If we assume that most VCs want to make at least 2X their capital, then all or some of their surviving companies must be able to provide that. So if a fund has $100 million in total assets and invests in five companies, the one surviving company must return $200 million to the fund. While this is certainly possible, in the world of venture statistics, it is not highly probable.

When there is a higher volume of surviving companies, you increase the number of opportunities that one of them could achieve a positive outcome. It’s worth stating that ALL surviving companies in a portfolio could fail or underperform and deliver less than what’s needed in this example to 2X the fund. But the point here is about increasing the probability of surviving companies that can produce the desired returns. One could argue that perhaps it makes sense to invest in as many companies as possible to increase the likelihood of more companies surviving long term. This is where it can get complicated as there are many factors such as fund size, initial and ongoing investment amounts, upfront and long-term company ownership, sector/industry focus, stage of investment (e.g., early vs. growth), capacity to manage the strategy, and so on, that also impact fund performance. In my experience, I’ve seen funds across various sectors who believe investing in fewer companies is optimal and I’ve seen some on the opposite end who invest in hundreds of companies.

Our View

The optimal number of companies to have in a venture capital fund portfolio is debatable. But the one universal truth is that no one knows at the onset which company or companies in a portfolio will survive and produce the desired returns. If anyone knew, the smartest thing they could do would be to put 100% of their resourced into that one company. But alas, it’s never that easy.

At Serac Ventures, we believe the right number of companies to invest in based on our sector focus, investment stage, and capacity to manage the strategy is 20 to 25 companies. If after 10 years, we have four surviving companies, we’ve estimated that the potential exit value of these companies based on a variety of factors (sector, market comps, etc.) provides us with a high enough probability to produce our desired returns. Other funds may have different strategies, but that’s less important. What’s most important is the thought put into understanding the “why” behind portfolio construction and then having the discipline to execute on it.

In next week’s post we’ll talk about why venture capital is important and how it compares to other asset classes.

Cheers — KM

Photo by Youssef Abdelwahab on Unsplash